How Do I Withdraw Money From Crypto Com

One of the many enticing elements of cryptocurrency is its highly futuristic nature — it's a form of money that exists primarily in a digital landscape and seems like a concept that could've been extracted from a sci-fi novel. But as cutting edge as this currency is, it still can't escape the basics. If you're interested in investing in cryptocurrency, you might be surprised to find that you still need a wallet to participate. This isn't your old-school leather bifold, though; it's something much better suited to digitized dollars.

Cryptocurrency wallets are actually unique software programs designed to store information about your crypto account that makes it possible to exchange, buy and sell cryptocurrency. Before you start mining Bitcoin or purchasing Dogecoin, though, it's important to understand what exactly these wallets are, how they work and how their security features protect you.

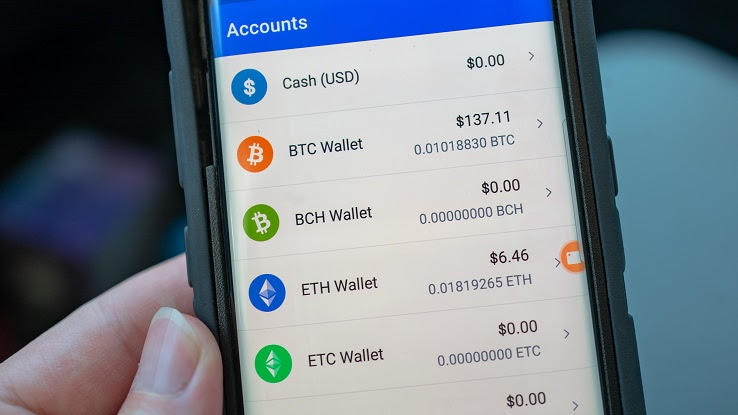

While they're commonly called crypto wallets, they don't hold cash. Instead, cryptocurrency wallets are software programs that store public and private cryptocurrency keys. These keys provide access to the blockchains (records of transactions performed with specific cryptocurrencies that work similarly to bank ledgers) that keep track of your cryptocurrency balance and your history of purchases and sales. The information you store in your crypto wallet is used to access, send and receive cryptocurrency through the internet. Popular cryptocurrencies like Bitcoin, Litecoin and Ethereum all use different wallets.

What exactly are the "keys" that these wallets store? Private keys are random strings of numbers and letters — sort of like passwords — that are each tied to an amount of cryptocurrency you've received in a transaction. Keys are randomly generated and, when private, are only made available to you. They provide access and control to one blockchain's cryptocurrency value, allowing you to exchange or sell the cryptocurrency tied to the specific key.

Public keys — in contrast to private keys — are similar to account numbers (called cryptocurrency addresses), and are what allow cryptocurrency users to receive crypto funds from other people. The numbers for public keys are derived from private keys but are encrypted so no one can work backwards from a public key to access the private one. As such, the risk of a security breach happening due to a decoded public key is low.

How Do You Use a Crypto Wallet?

If you want to buy and sell cryptocurrency, you'll need a crypto wallet. The keys stored in crypto wallets are what provide access to your transactions, your account balance, your exchange history and more. Without one of these wallets, you'll have no way of buying or selling cryptocurrency because there's no physical location where you can access a balance outside of the internet.

When it comes to using a cryptocurrency wallet, the process is fairly straightforward. Whenever you buy or exchange cryptocurrency from or with an individual, they will transfer over access to that currency to the cryptocurrency address you provide them with. This allows them to input the value directly into your wallet. The exchange of currency is accounted for in the blockchain. The private key then gives you the ability to control, sell and exchange the crypto funds in your possession. If you want to send cryptocurrency, all you need to do is locate the public crypto address of your intended recipient, choose how much to send and confirm the transaction. The convenience and ease of cryptocurrency exchanges is one of the perks that has contributed to the fast growth of the industry.

Understanding the Pros and Cons of Crypto Wallets

Cryptocurrency (and the possession of a cryptocurrency wallet) has plenty of advantages. With no physical money exchanging hands, the trading, selling and buying of cryptocurrency is a much more simplified process than in-person banking. A crypto wallet lets you make purchases from individuals in countries worldwide with no value lost in the exchange, which is the case of national currencies. Because the crypto network exists online and software engineers have intentionally built it with sophisticated safeguards in place, you can expect cryptocurrency wallets, in most cases, to be secure, private and stable. Cryptocurrency is also less susceptible to fluctuations in value due to economic shifts, such as inflation and deflation.

One downside of cryptocurrency wallets is that you can't backtrack on transactions — they're irreversible. This means if you accidentally send funds to the wrong address, you can't dispute the exchange, and your currency is gone. It's essential to be sure you're careful and double-check (or triple-check) your addresses before sending funds to another wallet.

However, you also have to be aware of scam cryptocurrency companies. While many major cryptocurrencies are becoming household names, smaller startup-type companies may seek to profit off of the trending crypto boom without actually supplying you with a valuable currency.

Are Crypto Wallets a Security Risk?

Because they're solely digital, cryptocurrency wallets (even when well-protected) are susceptible to a level of online interference. It's not much different from having your bank account information stored online — it's secure and you might never experience a breach, but the risk is always there. Blockchains are designed to be hack-resistant, yet there's still the possibility of malware meddling in your crypto.

One of the most common security risks is key-stealing malware, which can enter your device's hard drive through faulty links and spam email messaging. This malware scans your drive for private keys it can use to access and drain your accounts. Another risk is Trojan malware, which hacks your account or hard drive and threatens to crash your hard drive or expose sensitive information if you don't pay a crypto "ransom" to protect your device or information. Phishing scams that ask you to verify information via email or text can steal your wallet information, too.

It's important to remember that blockchains are designed to be highly secure. The majority of cryptocurrency hacking occurs when crypto users let their guards down by engaging with dangerous links, websites or accounts. Fortunately, you can still protect yourself.

One way to lower your risk is by securing your crypto wallet with two-factor authentication, which requires an additional action on your part each time you log in to your crypto wallet. Similarly to two-factor identification on your email account, you might need to enter a specific passcode or respond to a coded text message after inputting your password to your wallet account.

You should also be wary of emails or messages that ask for verification or private information, and double-check the sources that you're receiving mail or notifications from before engaging with any links. If you're genuinely concerned about a potential security attack on your crypto wallet, you can change your wallet from "hot" (online) to "cold" (offline), which protects your account from digital hackers. Keep in mind that, in an online market, this action makes your crypto more difficult to use and exchange — but it can provide the peace of mind you might need.

MORE FROM ASKMONEY.COM

How Do I Withdraw Money From Crypto Com

Source: https://www.askmoney.com/investing/crypto-wallet-cryptocurrency?utm_content=params%3Ao%3D1465803%26ad%3DdirN%26qo%3DserpIndex

Posted by: wongspermild.blogspot.com

0 Response to "How Do I Withdraw Money From Crypto Com"

Post a Comment